Mellon on the Markets

Inside the mind of the Master Investor: Influential British investor Jim Mellon reveals his latest thoughts on the markets.

| Master Investor Magazine

Never miss an issue of Master Investor Magazine – sign-up now for free! |

My last few missives have focused on precious metals, which have, rather like a reluctant cobra in a basket, begun to do their portfolio duty. Silver has caught up a bit with gold; by all means trade in and out of them, but don’t liquidate them entirely as these are going much higher.

In terms of shares and gold miners, Sandfire (ASX:SFR), with a yield approaching 5% and a low price-earnings ratio (PE), based in Australia, and seemingly well run, has gone onto my buy list. I have added to Condor Gold (LON:CNR), listed in London, and of which I am a director and now largest shareholder. I have also been buying Dart (ASX:DTM), in Australia, and Kefi (LON:KEFI) in London, both of them highly speculative. Silver is harder, but old standbys Fresnillo (LON:FRES) and Hochschild (LON:HOC) are OK to tuck away, in my opinion.

I think gold will hit new highs this calendar year, possibly close to $2,000 an ounce, and silver should breach $24 an ounce, a third up from the current level.

The reasons for buying gold etc are self-evident: this world is full of potential flashpoints, not least the US and China’s Twitter-inflamed trade war. The list of other fracture points is longer than normal. Then we have the fact that global net debt has trebled since the financial crisis, world economic growth is notably slowing, particularly in the mess that is Europe, and the lack of yield on precious metals is now irrelevant, as the lack of yield on bonds gets more and more crazy.

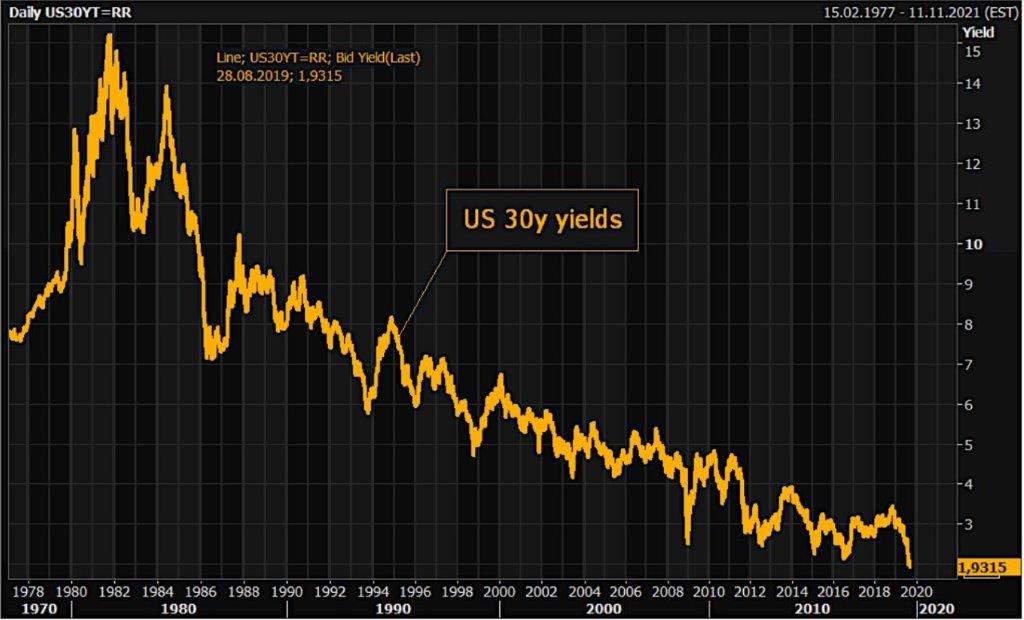

Although I am not a fan of jumping into the US market at this time, it is incredible that for the first time in decades the yield on US 30-year Treasury bonds is lower than the yield on the S&P.

We are in a weird period and the prescription for that is gold and silver. Gold has already made new highs in pounds, Australian dollar and euro terms. It’s only a matter of time before the same applies to gold in US dollars.

Speaking of the US dollar, in a debt-laden world short of dollars (think Argentina and Venezuela as examples), it is not surprising that the dollar has been relatively strong. It is also the case that US interest rates, while tumbling (see chart) are generally higher than elsewhere, and this is a pull factor for the dollar.

Don’t be tempted to jump on this bandwagon. A few months ago, I sold a bunch of euros and put the money in dollars. I now think that – wait for it – the British pound is a buy. This might be premature, what with dire predictions around a ‘no deal’ Brexit and Jeremy Corbyn advocating mass civil disobedience in the UK – but the time to buy anything is when the newsflow is overwhelmingly bad. (Not always, but in this case yes.)

The pound is outstandingly cheap, as is evidenced by foreign companies coming in to buy British assets in droves (Cobham and Greene King most recently), and those with a strong constitution should dive in now −both against the euro and the USD.

Also, British shares are cheap on an international basis, and I strongly advocate a smattering of UK blue chips in any portfolio. My picks include Vodafone (LON:VOD), Tesco (LON:TSCO), BP (LON:BP.) and Lloyd’s (LON:LLOY), all of which are terrific yielders and generally unlikely to disappoint in terms of maintaining their dividends.

In terms of trying to get ahead of another acquirer of British assets, I would suggest buying Marston’s (LON:MARS), a large owner of British pubs, with a good yield; and New River REIT (LON:NRR). It has a huge yield (13%), which may be unsustainable but looks uber cheap to me. New River has a balanced portfolio of reasonable retail properties and pubs, and the retail properties have the capacity to produce housing units on adjacent land.

About a third of all government debt globally is now negative yielding and anyone with an ounce of sanity must see that this is crazy and unsustainable. What will burst the bubble, I don’t know, but burst it will. Maybe Italy, where the 10-year bonds have gone to a ridiculous 1.2% yield might be the catalyst. Those who think Signor Salvini is going to go quiet now that he is not in government will end up with big losses.

Back to the day job… We just closed our Series B for Juvenescence, raising another $100m to advance the cause of keeping us all alive for longer and in a healthier condition.

I am heading back on the road next week, first (probably) to San Francisco for the Good Food Conference and Juvenescence. San Francisco is a place where I no longer have a flat, due to falling out of love with what used to be a glorious city, but now looks like something out of the Hunger Games. Then it’s over to Hong Kong for the massive CLSA conference, where I am speaking on things Juvenescent (hopefully without too much in the way of trouble outside), then quickly thereafter to the Middle East and Australia. En route to San Francisco, I am stopping in Miami to see my friend John Mauldin, whose newsletter is a must read for investors.

I’m hoping that I can catch up on my writing while in the air – I am due to hand in the second edition of Juvenescence quite soon, and I am also writing another book (subject to be revealed towards the end of the year).

While in Edinburgh last week, a couple of chums and I had a guided tour of the new aircraft carrier, Prince of Wales, which is about to start sea trials. It’s a magnificent ship, truly impressive and a proud example of British engineering. It’s costing £3 billion and worth every penny.

Now, I think the British government should follow the example of Austria (and, less gloriously, Argentina) and issue 100-year “century” bonds, raise £200 billion or thereabouts and build a lot more stuff. Interest rates are derisory; there must be some projects which can exceed them in terms of return, and now is the time before aforesaid bubble bursts. Be brave, be decisive!

Happy Hunting!

Jim Mellon

Dear Mr. Mellon, I have tried to buy some sandfire asx sfr.

the two online brokers I use don’t trade on the Australian stoke exchange

where can I buy into SFR