Bullet-proofing Brexit

There is only one word on the lips of investors right now and that is ‘Brexit’. It is a small word, indeed only six characters in length, and yet its impact has been so prolific that it has fuelled the most heated debate in a generation and has divided a nation. It is the ultimate marmite question if ever there was one – either you love it, or you hate it.

Never miss an issue of Master Investor Magazine – sign-up now for free! |

Whilst I have no more of an answer to the political conundrum than any of our seemingly incompetent representatives in Parliament, I do have a solution to the investment problem. You see, Brexit isn’t a big deal when it comes to finance, and in today’s column, the first I hope of many, I am going to do my level best to try to explain in less than a thousand words why this is the case.

The first thing to recognise is that investment of any kind relies upon one special universal factor which underpins the entire process and that is ‘certainty’. When you remove this from an investment portfolio, such is its importance it’s like removing a critical ingredient from a recipe, like removing sugar from a cake. You can still bake the cake, but nobody is going to want to eat it.

In its most rudimentary form the first thing that you need to know is that a person invests money for one reason and one reason only – to make money. That’s it. We can window-dress it, put fancy words on it and even relate it so some abstract 20th-century Black-Scholes financial modelling theory, but when all is said and done, people put their money into the stock market to make money.

The second point to consider is how to make money and that’s where the certainty bit comes in. You see, the more certain an investor is that they will make money, the more they are prepared to invest. Conversely, the less certain that a person is in something, the less likely they are to invest. Pretty simple so far, right?

The price is always right?

Okay, so the third and final piece to the jigsaw that we must consider is the price.

The price is the market’s attempt to calculate what it believes to be the ‘fair value’ for an investment. In other words, it is supposed to be the equilibrium price which fairly rewards you to take on the risk and for you to buy that investment. If it’s seen as a risky investment, then you would expect the price to be low but if it’s a very safe investment then you would be prepared to pay a higher price. That’s how the price of stocks and shares work, it’s how the price of property works, and it’s how the price of oranges and apples work.

Here’s the good news. Come in closer, I don’t want to say this out loud. {Whisper} Sometimes the market is wrong.

Yes, that’s right – don’t repeat it in case somebody is eavesdropping but you did hear me correctly.

You see, contrary to popular belief, the price of the stock market is not decided by the value of a company, it’s made up by everyday people like you and me. This means that if the media paints a particularly bleak picture of Brexit and people believe that story, then they are likely to sell more aggressively than they should which in turn will drive the price down artificially. That means an opportunity for savvy investors to buy shares at a price below fair value – or what I like to call a bloody good bargain.

Now I’m not suggesting that the market is under-valued right now and that you should buy, far from it. But what I am saying is that you shouldn’t be fearful of the market and you should see the volatility and the uncertainty as an opportunity rather than a risk.

Uncertainty equals opportunity

If you are looking to make money then you need uncertainty because without it, you are almost certainly paying too much for the investment. The uncertainty plays on irrational fears and as humans we are prone to making mistakes which means that we over-think things and worry when we shouldn’t.

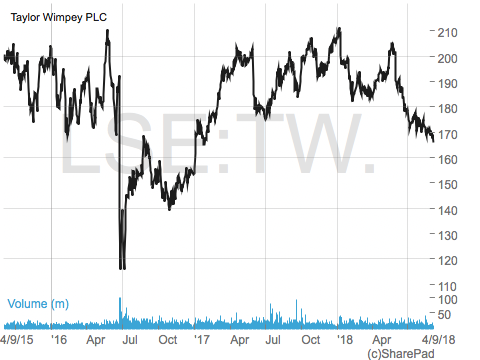

Look at what happened with Taylor Wimpey after the results of the Brexit referendum vote in June 2016. They dropped from 200p a share down to below 120p and then back up to 200p again within a few months.

Brexit is a word. That’s all. It’s not going to kill us, it will not cause any long-term damage to the UK economy, and if you are smart, it could well provide you with the best trading and investment opportunities of a lifetime.

That’s why right now, I am doubling down on capital protection for my clients because I believe that in the short term, the market is headed lower due to greater uncertainty that we face as we move closer to next year’s 29th March deadline. That means hedging portfolios through put options, sensible diversification through global funds, inverse tracker Exchange Traded Funds (ETFs) and, dare I say it, using shorting instruments like CFDs is the best way to go right now.

In other words, don’t invest more – protect what you already have. That’s because the downside risk is considerably greater than the upside potential.

I am also focussing on being overweight on key sectors which I believe will suffer the least – for example, commodities and oil and gas – whilst avoiding those sectors which will be most adversely affected – including housebuilders, for example.

Embracing Brexit

Never miss an issue of Master Investor Magazine – sign-up now for free! |

But that’s not it. That’s just one side of the coin. The other side is where the money will be made and that’s understanding that Brexit is more about opportunity than despair and destruction, at least when it comes to investing.

The fact that last week Theresa May was happy to be seen dancing with little African children to boost international relations, despite the UK exporting just 3% to Africa compared to 53% to Europe, should tell you something (other than that she has no rhythm). It tells you that she’s pretending at least not to be worried – I’m not worried either, and neither should you be. There’s no nothing to worry about.

Even if the market crashes 1,000 points tomorrow, and provided that you have the right level of protection to your portfolio, then you should have nothing to be concerned about. If on the other hand, crossing your figures and planting your head between your legs is your preferred hedging strategy then, then you have a lot to worry about.

So, let me leave this final thought with you – doing well when it comes to investing in the stock market is much less to do with a six-letter word and everything to do with a three-letter word. It’s not about Brexit, it’s all about you.

For more information about how you can protect your investments and make money whatever Brexit throws at you, you can email me at rsingh@londonstonesecurities.co.uk.

Comments (0)