Sirius Minerals – Private Investors Take Care!

With a £2.5bn programme to built its potash (strictly – polyhalite) mine in Yorkshire, Sirius Minerals (AIM:SSX) plans to become by 2022 the largest operating underground mine in Britain, if not in the British Isles. Promising also to be one the cheapest suppliers of a unique multi-nutrient fertiliser to a hungry world agricultural market for approaching 100 years, it should also become a highly profitable one, and as such, of great interest to UK institutional investors. When, that is, they are allowed to invest, which will only be when Sirius moves up from AIM, where it listed in 2005 at 5p, or when they sign up to a financing deal that is now under discussion.

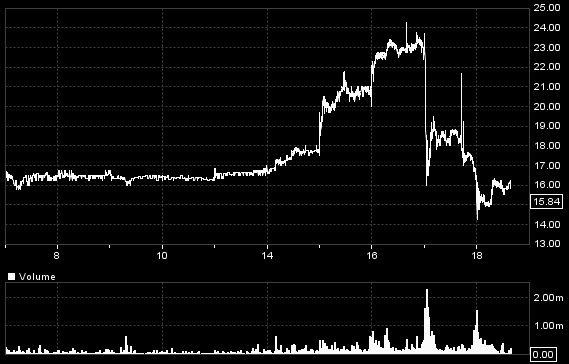

As the chart shows, there has just been a sharp flurry of interest. On 16th March over £8 million worth of shares were traded – pretty large for an AIM stock – as investors looked forward to a key piece of news the next day – the updated Definitive Feasibility Study, which for the first time (partly because its design has changed since previous studies) has put solid (within 10% accuracy) numbers to the long-term economics of Sirius’s project. Based on some brokers’ original ‘targets’ (my regular readers will know what is coming) of some 50p or 70p per share, investors on the bulletin boards were talking excitedly of the shares – having closed at 23p on the 16th – doubling the next day.

Sirius Minerals 10 days to March 18th 2016

I could of course have told them they were due to be disappointed (I wrote these opening paragraphs on the evening of 16th March!) – as they duly were, with the shares losing 24% on the announcement next morning and even more today as I write – and not just because the project capital cost is turning out higher than expected.

Once again, and on a rather larger scale than I’ve seen among the junior miners where it is rife, private investors were bamboozled by the distinction between the NPV of a project which a company owns (or only partly owns) and the value of its shares, and bedazzled by the sheer size of that NPV. Widely expected to be in the £12bn region, the DFS now defines it as a long-term (very long-term) £10.5bn (at a 10% discount rate, or £17.2bn at 8%) in return for a £2.5bn initial capital investment (rising to £3.6bn in the medium term) delivering an almost 26% IRR. These are all pretty good figures at the project level…

…But not necessarily at the shareholder level. Even before the necessary judgement could be made about the structure of the funding that Sirius will have to find before putting a spade in the ground, so that a stab can be made as to the loans to be raised and number of shares to be issued and at what price, so as to make even a rough guess as to future earnings or value per share, some of those brokers were putting forward their ‘risked’ NPV per share – the estimated NPV divided by current shares in issue, to which they then accorded a ‘risk’ discount.

Needless to say, bearing in mind the sheer scale of the capex needed – five times Sirius’s market value – that sort of calculation always was almost completely meaningless, even with the (inadequate) 50% discount they applied. What is needed instead is a figure for the diluted ordinary shares, which cannot be even guessed at without much more information.

But, as I say, that was on March 16th, before we had the figures and a hint of some of the information, and after the company itself had for some time been flagging ‘projections’ of the share price that it said might be justified by various assumptions about financing, the level of production (and sales) achievable, and the profit margin. In other words, a calculated end result which is highly sensitive to each of three, highly variable, and relatively unpredictable, assumed inputs! No mathematician or engineer – let alone hard-headed financier – would touch such an airy fairy result.

Anyway, now that they have the DFS results, some of those harder-headed bankers and potential equity investors will be looking at them. Sirius says it wants to raise stage one financing (£1.1bn) to get the mine into production at a reduced rate from 2022 onwards, after which stage two to bring up to full capacity by 2028 will cost another £1.4bn.

And there seems no doubt Sirius has a world-beating project in its hands. Banks and institutions will be very interested, but as a mere equity analyst and scribbler I’m only concerned with what will be left over for ordinary shareholders. The banks and institutions will be looking after themselves – extremely well, going by Sirius’s assumptions in its DFS presentation about their likely terms. And the better they butter their own toast, the smaller will be the crumbs (or they might be big haunches of pork – only the detailed sums based on far more detail will tell us) left over for the private investor-shareholder.

Sirius says stage one financing will comprise structured debt, together with equity from new, cornerstone investors and/or current shareholders, in whatever proportion the debt providers will require. (“It is the intention of the Company to seek conditional commitments from the structured debt providers first, and then to complete the required equity component to satisfy the conditions of the debt commitments.”) Bearing in mind what I think are still significant risks in its business plan, the terms will be very generous – to them, the debt providers. The debt is expected to be at 10-15% interest, plus share warrants, while (new) equity investors are expected to require a 25% p.a. return on their investment. To earn that eye-watering rate (usually applied to risky projects in far-away lands) means new equity will have to be subscribed at a very low share price – implying heavy dilution for present shareholders.

So this stage one financing will take away a big part of the project’s value – something glossed over in one of Sirius’s presentation diagrams (page 42) titled “Strong value appreciation through ramp-up – Significantly undervalued in the current market” which graphs the project NPV as it rises (because part of the capex has been met, leaving a larger and larger ‘gross PV to come) at each stage. Which is fair enough, except that the diagram compares these with Sirius’s much smaller market value and implies that the ‘gap’ between the two is the value to shareholders that is not yet being recognised in the share price.

Needless to say, the NPV is not, in any case, a ‘value’ that equates to a justifiable share price, in addition to which that ‘gap’ will be eaten into by the costs of funding, and – for shareholders – the dilution stemming from the very large expansion in shares to provide the equity risk-taking ‘cushion’ the banks will require.

And those risks look quite high. Starting with those NPVs – which are calculated taking in net revenues up to 50 years ahead. “50 years ahead”? What investor in his right mind is going to give credit for income in 50 years time? As it happens however, at an 8% discount rate, the NPV would reduce by only 15% if 25 years is taken, but by nearly 40% if ten years is taken, which I suggest is the time-scale most investors would consider reasonable. That big chunk out of a realistic NPV is one reason why new cornerstone equity investors will require that big profit on their subscription price, at the cost of heavy dilution to the existing shareholders.

And the other risks? The company implies they aren’t very great – because its fertiliser product is unique; provides farmers with a much better value source of the key ingredients they need; and it has already pre-sold 45% of its first 5-10 years’ production to customers in North and South America and China, and has expressions of interest covering another 34%.

But one risk to those long-term projections has to be the prices Sirius expects. At present it is assuming, quite reasonably, a substantial premium over prices for competing fertiliser products precisely because its own is technically very much better and should make big inroads into the existing, expanding, market. The company’s presentations accordingly include persuasive looking marketing and economic projections.

Which are all very well, except that I would imagine institutional investors will be taking much of them with a pinch of salt – until Sirius has proved its product in the world-wide market – which won’t happen for a good ten years.

So here we have an enormous project, likely to be a significant contributor to the UK economy, and with characteristics that will appeal to long-term institutions and insurance companies, but with so many unknowns (despite being cushioned to some extent by a seemingly juicy margin between the projected NPVs and the eventual capital cost) that it is not surprising that – as the company says – “Discussions have been under way for a significant period of time with providers of the structured debt and also potential equity investors.” I imagine those talks will continue for some time yet.

Sirius also says “the company is focused on balancing returns to both existing and new capital providers“. Yes, well, all companies looking for mega-funding say that, but I don’t see how it can be done without the market value of its shares playing ball, which it isn’t doing at the moment.

Because the value of Sirius’s shares will be extremely sensitive to the equity dilution that will have to be borne, and because the latter is highly dependent on the extent of structured debt to be raised and potential investors’ views of those NPV figures, I think it is far too risky at this stage to attempt any valuation, until much more of the funding details are known, and I imagine they won’t be available for some time. That, of course, hasn’t prevented brokers updating their ‘targets’ to the 50p-65p regions. They have to earn their crust I suppose, but readers will know what I think about their ‘targets’.

And, next time, I imagine investors won’t be as foolish as they were on March 16th to try to guess the implications, and deal in the shares, in the run up to any detailed funding announcement. What value is left for ordinary shareholders will be a difference between some very large numbers, and to mess around with them runs the danger of being ground to a financial pulp if they move the wrong way. There will be plenty of time over the next five years to consider investing in this company, and even if funding is secured and forecasts can at last be made of earnings per share (not starting until seven years’ time) and potential dividends, the shares will quite likely prove to be volatile enough for the most hardened trader.

Comments (0)