John’s Mining Journal: Waiting for Gold-ot

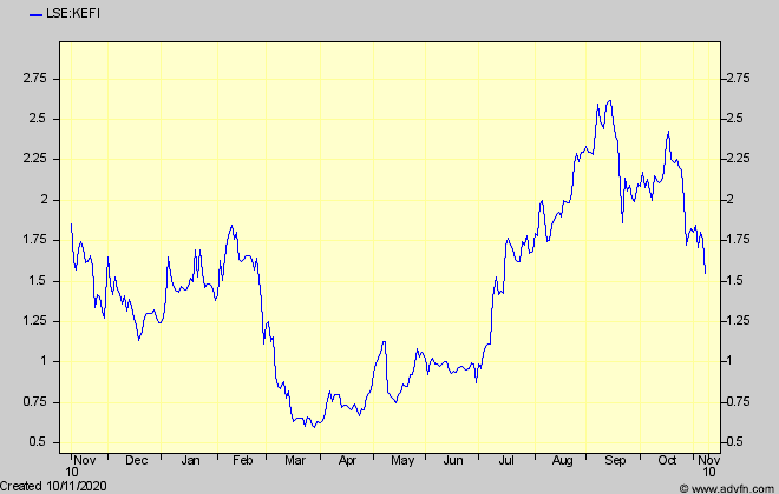

KEFI gold and copper. Market cap £30m @ 1.6p

I always seem to be writing about Kefi Gold and Copper, and its latest delay. The most recent one however, even though it seriously dented the shares when announced three weeks ago, is not as bad for Kefi’s prospects as the shares’ performance suggested. It does however mean a possibly longer delay than investors were hoping for.

(But as for the very latest, smaller, dent in the shares, that has been caused by the resumption of trouble from rebels on Ethiopia’s northern borders. Although the government seems to have it under control, investors can never know what effect it might have on Kefi’s Ethiopian Tulu Kapi project. It doesn’t seem to be worrying the shares too much as I write however)

The first mentioned delay is to give time for a revised, comprehensive, $221m funding package for Tulu Kepi to be agreed and signed. The previous delays were due to a key funding partner and prospective mine contractor ANS dragging its feet in coming up with its promised initial payment, perhaps because itself has been badly affected by the covid-19 lockdowns.

That is now to be replaced by two new ‘experienced’, unnamed African investors. Observers speculate that these might comprise $1.3bn Centamin even though (or perhaps because) it has its own troubles at its Sukari mine in Egypt, and a ‘leading global commodity trader’ – in other words a gold streamer or provider of so-called ‘gold loans’, which are cheaper in the long run than streaming deals.

Kefi says the restructuring will increase its Tulu Kepi share from 45% under the previous scheme, to 65%, where it says its NPV share will be £96m at a $1,000/oz gold price (or 11p per present issued shares). Its not clear yet whether that figure takes account of the new financing terms. A streaming deal, for instance, will take away some of that NPV.

So, despite the delay, KEFI remains the same attractive looking investment, with its risk steadily reducing as its other promising exploration project at Hawiah in Saudi Arabia, which is not priced into the shares, gathers momentum.

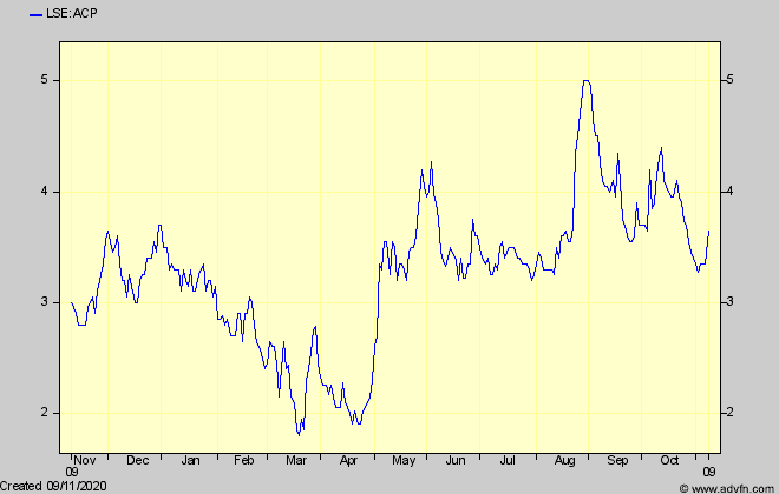

Armadale Capital (AIM:ACP) market cap £16m @ 3.6p

In my July 7 blog I mentioned Armadale Capital with its Mahenge graphite project in Tanzania, whose chart shows it is waiting for financing news for a project which has highly attractive looking economics.

I said that I would look at ACP’s somewhat complex capital structure, with convertible loans and warrants which might hold the shares back, despite looking very cheap at a £16m market cap, compared with Mahenge’s approximately £240m post-tax NPV at a conservative 10% discount rate.

The project also has a 91% irr, which should make for readily available financing, which ACP has been discussing, now, for some months.

So, with the chart showing potential on any positive announcement, it is time to clear away whatever reservations there might be on that share structure account. Warrants, options, and convertible loans outstanding, if all converted, would expand the current 445.2 million shares in issue to just over 1bn, while raising some £3m in working capital towards what at present is a modest cash burn around £1/2 million per year.

So that should not be a problem, and with the initial spend to get Mahenge in production by the end of next year at less than $40m, the further share dilution or financing cost to raise it would produce only a small additional dent in the true NPV per share.

ACP is discussing financing with two prospective ‘investment partners’, and while that might mean a ‘farm-in’ by someone to help build the mine, or perhaps a streaming deal with one of the three Chinese graphite processors with whom it announced memorandums of understanding in 2019 to take Mahenge’s product, all we can do is to assume a project loan from a bank.

For that, a $30m 5 year loan at 10% would cost about $7.3m pa in repayments and about the same amount as a reduction in the 10% NPV. That would leave the 10% NPV (after financing the project – ie it is the discounted value of the project to its equity owners at start of production) at over £250m.

If the remaining initial $10m equity is financed all by ACP shares even at the current low 3.6p, total shares would still be less than 1.3bn, making the true, adjusted, NPV/share almost 20p.

Although my rule is usually to more than halve an NPV-derived ‘share price’, the 10% discount rate used in this case looks quite conservative, and the more usual 8% would increase it by another 30%, so in the eyes of investors when (if) the project is agreed, ACP will look very attractive at up to at least double the current share price, and more if the graphite market starts to reflect long term projections for it.

Agreement however is not quite there. ACP is working to convert the Chinese MOU’s into binding agreements, while waiting for the grant of the mining licence which it seems to expect fairly soon. On top of that it has already selected an engineering group for the mine processing plant design.

Once the mining licence is granted, and with financing and binding offtakes in place, ACP says it could be in production within one year, further adding to ACP’s attractions among miners who usually take much longer. That would be especially true now that a cure for the covid-pandemic might re-start the global move to electric vehicles and the graphite they will need. And if that same process dents gold’s glitter for a time, investors will be looking for companies benefitting from those metals and commodities that have been overlooked recently.

One small snag that investors could eventually focus on, but not until after production start, might be that the project will be in two stages, with a c$40m initial capex followed within 4-5 years by another $40m or so. That will double stage one production to the full planned rate which, presumably, is the rate producing the high irr and NPV that the company is stating for the whole project.

So, while ACP says that the further investment will be ‘covered’ by the cash generated from phase one, investors have no means at present of knowing how that will impact ACP’s cash flows in the first few years, nor what the true NPV is for the first stage of the project. But it is unlikely to be so different from what is currently being stated as to damage the shares’ attractions.

Hi John,

Thanks for this article, an interesting read. On ACP, I’d be interested to understand where your calculations come from for the outstanding CLNs, warrants and options. I get to a current calculation of about 120m – CLNs around 30m, warrants 84m and option 6m.

Any guidance appreciated on what I’m missing.

Ben