Forte Energy Gets A Going Over From SP Angel

There was some interesting commentary from that old stager John Meyer and the team at SP Angel in their morning note today.

“No exploration just a massive loss on derivative financial instruments” ran the headline bullet point for their thoughts on the latest news from Forte Energy.

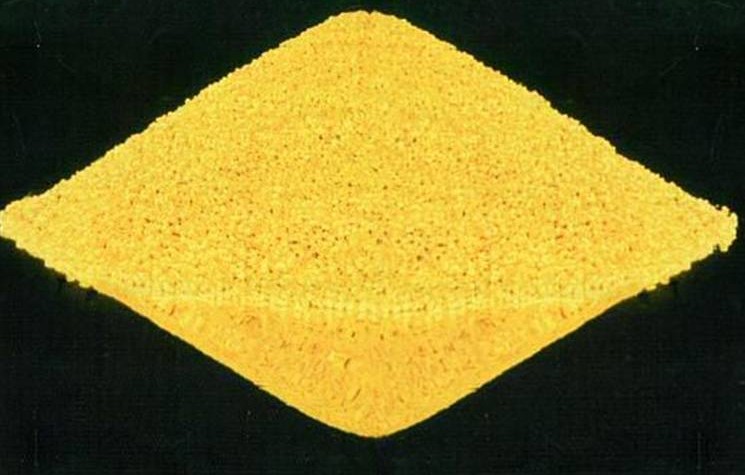

Once a notable force in the small cap uranium space, Forte Energy has in recent years subsided into a virtual cash shell, continuing to sift over assets, but not apparently actually doing that much.

“Forte Energy”, says SP Angel, “appears to have given up exploration and is just mining the market for now. The board hides out in Perth with little interaction with its prospects in West Africa, though they did sign a joint venture with European Uranium for a 50 per cent stake in its Slovak uranium properties.”

Be that as it may, the company’s most recent losses apparently derive less from its efforts to uncover the next big Langer Heinrich, but more from attempts to play other kinds of market.

“The interim report”, says SP Angel, “contains a lengthy and complex description of the company’s derivative financial instruments which appear to have cost the company a hefty loss of £1.3 million.”

And if that wasn’t enough for shareholders to be contending with, there’s also the harsh reality of ongoing dilution.

“On 30th December”, continues the SP Angel commentary, “just when the company thought no one would notice, the company agreed a £550,000 convertible loan agreement (a form of equity drawdown facility) with Darwin Strategic.

What’s more, the company’s share swap deal with Global Resources Investment Trust, run by Willie West and Sam Hutchens, is also looking the worse for wear, as GRIT’s shares are now a long way shy of the 92.5 p at which they were trading at around a year ago.

And in an additional twist to an already pretty gnarly set of financing arrangements, two directors, Glenn Featherby and Mark Reilly have been lending money to the company. In the case of Mr Featherby, SP Angel notes that a “princely facility fee of US$20,000” was charged.

How much confidence should all this inspire in investors? The answer is not much. Regular readers of Minesite will have taken due note of the warning we gave about the company back in 2013 [http://www.minesite.com/2013/06/17/forte-energys-latest-loan-and-seda-at-least-ensure-directors-will-be-paid-the-annual-a1-3-million-they-take-out-of-the-company/], back when the shares were still trading up at close to 1p.

They are now just a little way north of 0.1p and the 11p of 2011 is but a distant dream.

Still, SP Angel still retains some hope. “We are keen to see the potential of the Slovak projects in the European Uranium joint venture and hope rising uranium prices might turn this deal into a more compelling investment.”

Comments (0)