Zak’s Daily Round-up: BAE, LLOY, FEVR, REM and SSX

Market Direction: S&P 500 Above 200 Day Line Targets 2,100

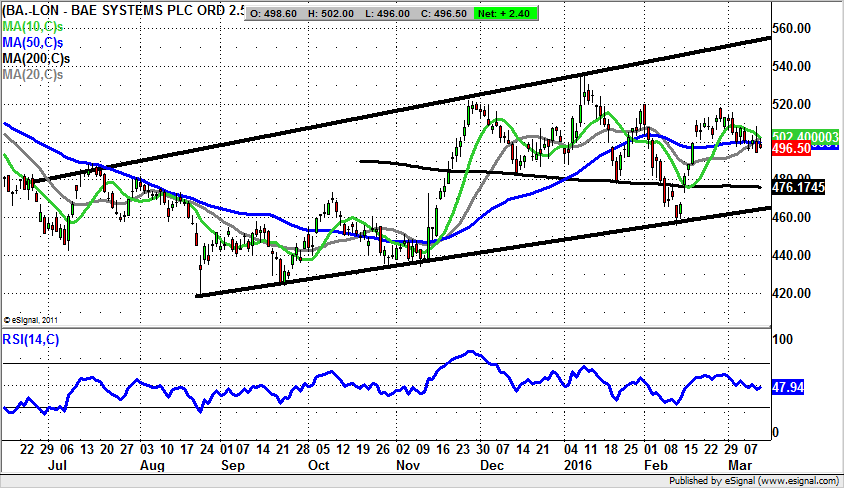

BAE Systems (BA.): 560p June Price Channel Target

I have to say that I find it interesting how day in, day out, BAE Systems is one of the most looked at share price quotes on the London Stock Exchange. This is over and above the banks, miners and any of the minnows, something of an achievement considering that one would not imagine that there are the day to day influences on the share price of the aerospace / defence group, unless you include the daily horrors from war zones around the world. As far as the recent price action here it can be seen how the shares have been in consolidation mode since the sharp bear trap rebound in February. This consisted of a gap up reversal from below the 200 day moving average now at 476p. The bounce was also off the floor of a rising trend channel, one which has been in place since as long ago as June last year. The support line came in just below 460p for the shares last month, with the issue now being what further retracement we may see, if any from present levels, after last month’s double top through 520p? The best way forward may actually be to wait on a fresh momentum buy trigger such as an end of day close back above the 10 day moving average, now at 502p. This should lead to a new leg to the upside over the next 1-2 months. The favoured upside would be the top of last year’s price channel as high as 560p.

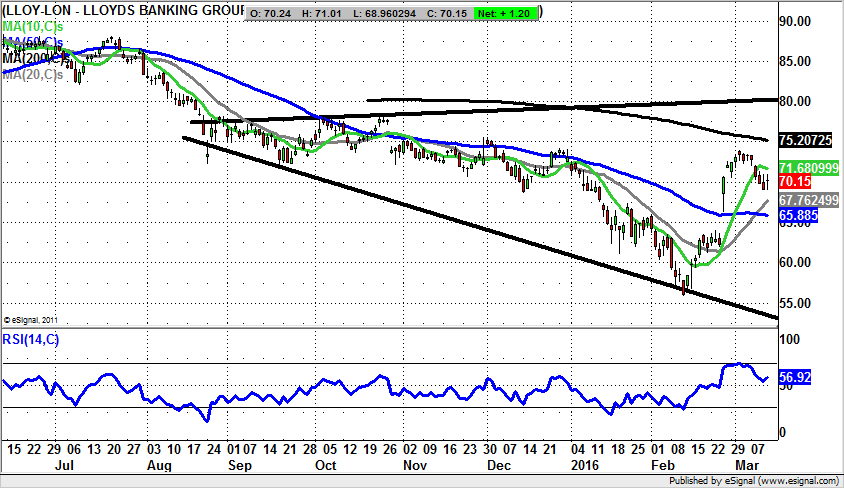

Lloyds Banking (LLOY): 80p Technical Target – Above Government’s Breakeven Level

The recent history of Lloyds Banking has been noteworthy to say the least. This is because the proposed share sell off at the start of the year was shelved, even though as it turned out, if it had happened the buyers might have been in at a very cheap price below 60p. Since then the bank has very generously handed out a special dividend of £2bn to shareholders, something which it had to get permission from the Government for. This may have been a rubber stamp affair given the way that such a payout would be guaranteed to lift the share price, and give the Government a decent chance of selling out more shares at 73p plus – its break-even level. In fact, the best level since the great 2016 recovery started here has been 73.9p – strangely enough. From a charting perspective it is evident that we have a broadening triangle formation in place on the daily chart, with likely support towards the 50 day moving average at 65.88p, near the top of the February gap. The view at this stage is that the best on the upside here could be as high as the top of the August triangle at 80p – Government selling of the stock notwithstanding. The ideal scenario is that over the next week we are treated to an end of day close above the 10 day moving average at 71.64p, with this being the momentum trigger for a new leg to the upside.

Small Caps Focus:

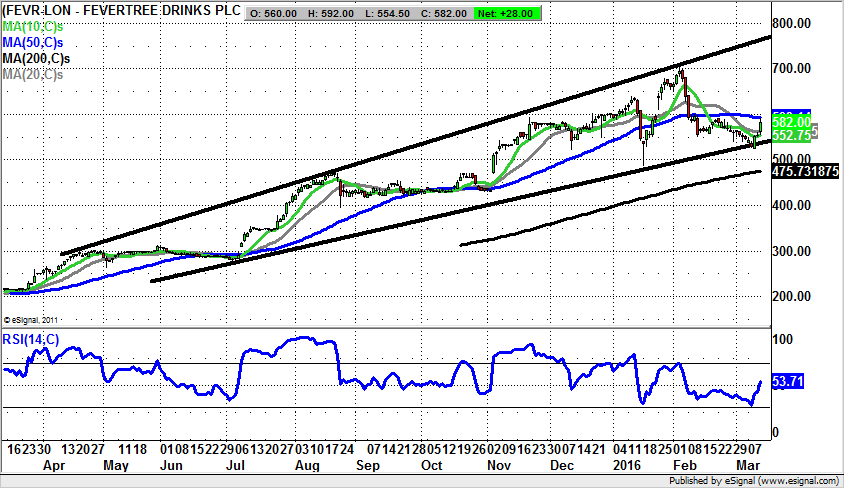

Fevertree Holdings (FEVR):

Fevertree Holdings looks to have become something of a stock market darling, if only on the basis that apparently every bonus hungry fund manager in town regards it as a “set and forget” investment. It bears all the hallmarks of a decent stock – admittedly – an upmarket / high margin / niche play, with decent management. Also in current stock market conditions it would appear that little can go wrong. Tonic water is not rocket science, and of course, people will always need to drink – too much. The only real danger is that the rating on the stock becomes too rich. In the meantime we have the shares trading in the wake of a pullback from the February high towards 700p. Interestingly enough we have held the floor of a broadening triangle formation, one which has been in place since April last year. The floor of the channel currently runs level with the 10 day moving average at 552p. The assumption to make over the next few weeks is that provided there is no end of day close back below the price channel floor we should be looking to a best case scenario target as high as 800p. This could be achieved as soon as the end of April, or perhaps going into May. Only cautious traders would wait on an end of day close back above the 50 day moving average at 593p before taking the plunge on the upside. This is even though the latest break of neutral RSI 50 to leave it at 53 should be enough to deliver the positive momentum we are looking for here.

Rare Earth Minerals (REM): Possible Falling Wedge Reversal

It should be said that as far as being a disappointment is concerned, Rare Earth Minerals has been one of late, especially given the way that the fundamentals courtesy of Tesla (TSLA) are apparently sky high. That said, it could very well be that finally the technicals on the stock come to the rescue, after ensuring that for the best part of the last couple of years shareholders have been suffering something of a sinking feeling. This is because it would appear the stock is in a bullish falling wedge formation, one that could drag the stock up to the main initial 2016 resistance at 0.8p plus. This would be in the region of the 200 day moving average, currently at 0.84p. The timeframe on such a move should be as soon as the next 1-2 months. Only cautious traders would wait on an end of day close back above the top of the falling wedge at 0.7p, before taking the plunge on the upside. That said, aggressive traders would already be in place after the wedge floor rebound, and November RSI uptrend line rebound we have just been treated to.

Sirius Minerals (SXX): Tight Bull Flag At 200 Day Line Targets 25p

The initial obvious reaction after the latest spike to the upside for Sirius Minerals shares would have been to assume that one had missed the boat. But thankfully, the aftermath of the latest week’s price action suggests that we are in a mid move consolidation with a bull flag either side of the 200 day moving average at 16.8p. The assumption to make now is that at least while there is no end of day close back below the 10 day moving average at 15.5p the upside here over the next 1-2 months could be as great as the top of a broadening triangle with its resistance line projection heading to 25p.

Comments (0)