Zak’s Daily Round-Up: BDEV, OML, SDR, UU., CVR and HNR

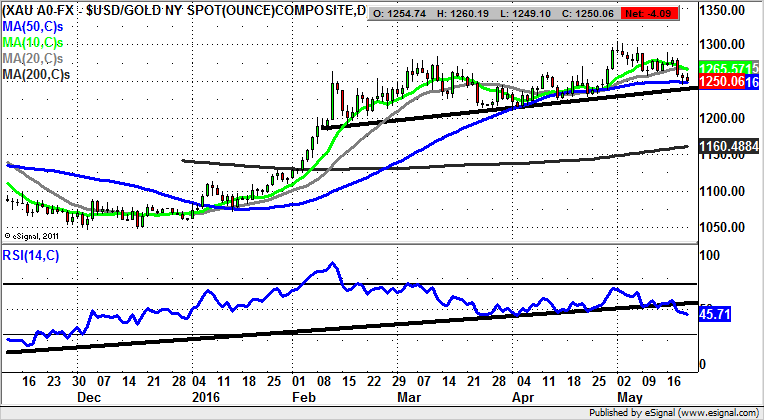

Market Direction: Gold, Neckline Support below $1,250

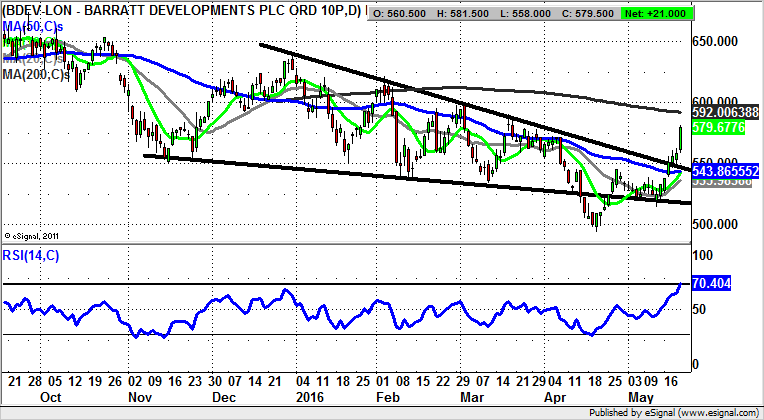

Barratt Developments (BDEV): December Resistance Target

It would appear that there is plenty to celebrate at the moment as far as the recent charting action at Barratt Developments is concerned. This is said in the wake of last month’s as yet unfilled gap to the upside, after a sharp bear trap rebound below 500p. The position now is that we are looking at the aftermath of a second unfilled gap to the upside for May, through the 50 day moving average at 543p. This has also been a break of a falling wedge bullish formation that has been in place on the daily chart since as long ago as November. The message going forward is that provided there is no end of day close back below the 50 day line, one should be right to be chasing further significant upside. The favoured initial target is clearly the 200 day moving average at 592p, but a decent end of day close back above this key feature would suggest we are set for a “minimum” push up to the late December peak at 638p. The timeframe on such a move may be as soon as the end of June.

Old Mutual (OML): December Price Channel to 205p

The low of the February gap was 160p, while the low since then has been well above this level, especially in terms of May support to date at the 163.89p. This failed gap fill set up is one of the strongest in the charting book, and suggests that wherever possible we should give this situation the benefit of the doubt as far as the upside argument is concerned. One would make such an assumption while there is no end of day close back below 160p. Otherwise it would appear that all we are looking for here is an end of day close above the 10 day moving average at 169p. Such an eventuality is currently being flagged by the latest double bounce off the extended RSI support line from January heading below 30/100. At least what can be said for Old Mutual on an intermediate basis over the next few weeks is that there should be a rally towards the present area of the 50 day and 200 day moving averages at 185p. The 2-3 month target above the 50 day line is as high as 205p, which is the top of a rising trend channel from December.

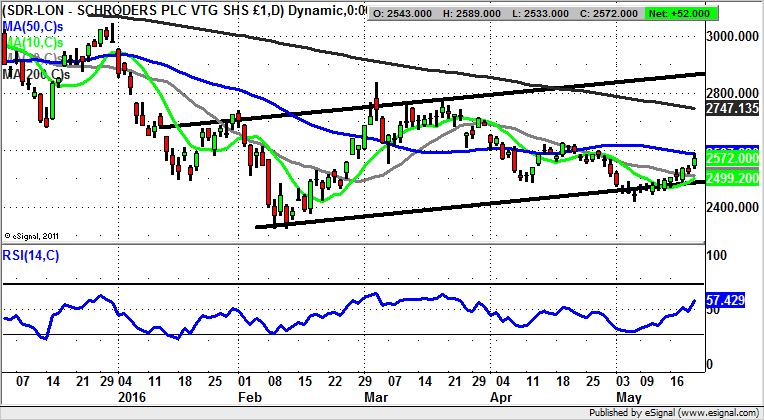

Schroders (SDR): April Bear Trap Rebound

Despite the February breakdown for shares of Schroders, the overall pattern here has been that of a rising trend channel which can be drawn in from as long ago as January. The floor of the channel currently runs at 2,499p, the level of the 10 day moving average, with the message being that provided there is no end of day close back below this level one would be correct to expect further significant upside. This is especially the case while there is no end of day close back below the April 2,483p intraday low. While above this one would be looking for this stock to head as high as the 2016 price channel top at 2,850p over the next 6-8 weeks. Only cautious traders would wait on an end of day close back above the 50 day moving average at 2,587p before taking the plunge on the upside. This is because the RSI now at 57 has already flagged a potential new leg to the upside, given that the oscillator is very often a leading indicator on price action.

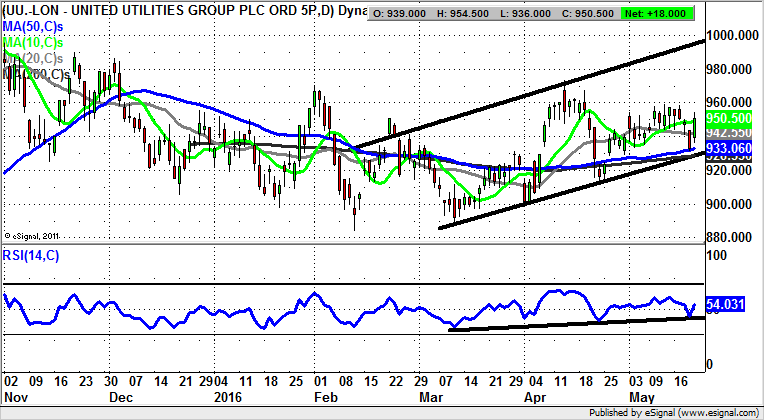

United Utilities (UU.): Above 50 Day Line Targets 1,000p

The recent history of United Utilities is that of a stock which served up an exhaustion gap reversal in March, and then gapped above the 50 day moving average now at 933p twice in April. The position now is that we have been treated to a rebound off the 50 day line, with the message at the moment being that while there is no end of day close back below the 50 day line one would expect to see a journey towards the top of the February price channel top as high as 1,000p over the next 3-4 weeks.

Small Caps

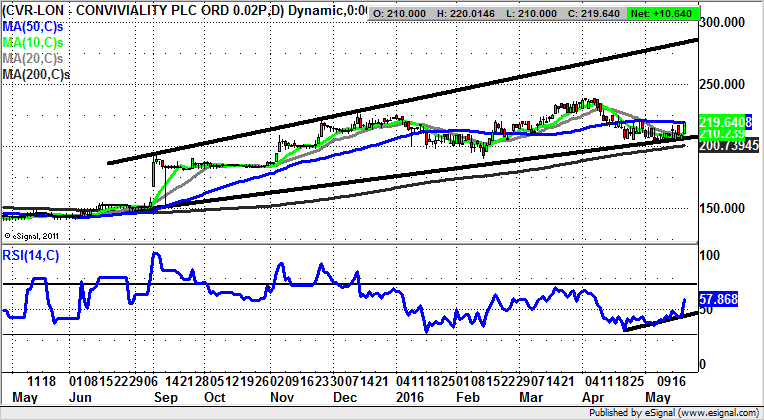

Conviviality (CVR): Broadening Triangle Targets 285p

A major part of the message in terms of coverage of small caps on Master Investor from a technical perspective has been to feature companies where the price action has been trending strongly to the upside. The hope in such situations is of course that the trend will continue. This is certainly what we are looking forward to on the daily chart of Conviviality in the sense that there has been a rebound off the floor of a broadening triangle which can be drawn in from the summer. The floor of the channel currently runs at 205p, just above the 200 day moving average at 200.74p. The implication is that provided there is no end of day close back below the 200 day line we could see a retest of the April resistance through 230p. But only a weekly close through the highs of last month would open up a journey towards the 2015 price channel top at 285p over the next couple of months.

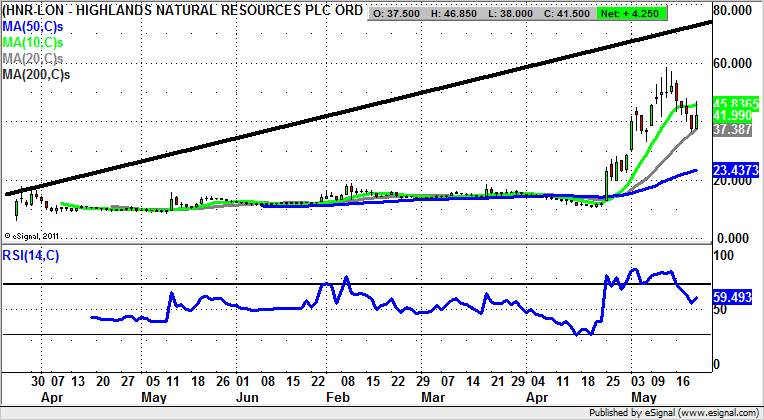

Highland Natural Resources (HNR): Still On For 70p

It is interesting that many traders will have been caught out by the ferocity of the upside scenario for Highland natural Resources – a point underlined by the way that the initial technical target here once above 20p was as high as 40p. This was then revised up to a 70p target, which of course currently appears to be a long way away. Nevertheless, we have just been treated to an early gap fill rebound as well as a bounce off the 20 day moving average at 37.38p. At least while there is no end of day close back below the 20 day line one would be happy that we are still on track for 70p over the next 1-2 months.

Comments (0)