Themed Watchlist 6

Over the last couple of posts I looked at commodities and concluded that we may be about to see a reversal on some key commodities that, in turn, impact on my themed watchlist, based on the Met Office prediction of two hot record breaking years globally, and my counter analysis that discounted their prediction of a cold winter here in the UK.

Input costs for Electricity have been falling; but then so is demand as we’re having a very mild winter. Coal is a really awful looking chart which I posted with my Commodities Update posts. I’ve looked at Gas & Multiutilities for this themed watchlist but not Electricity companies per se.

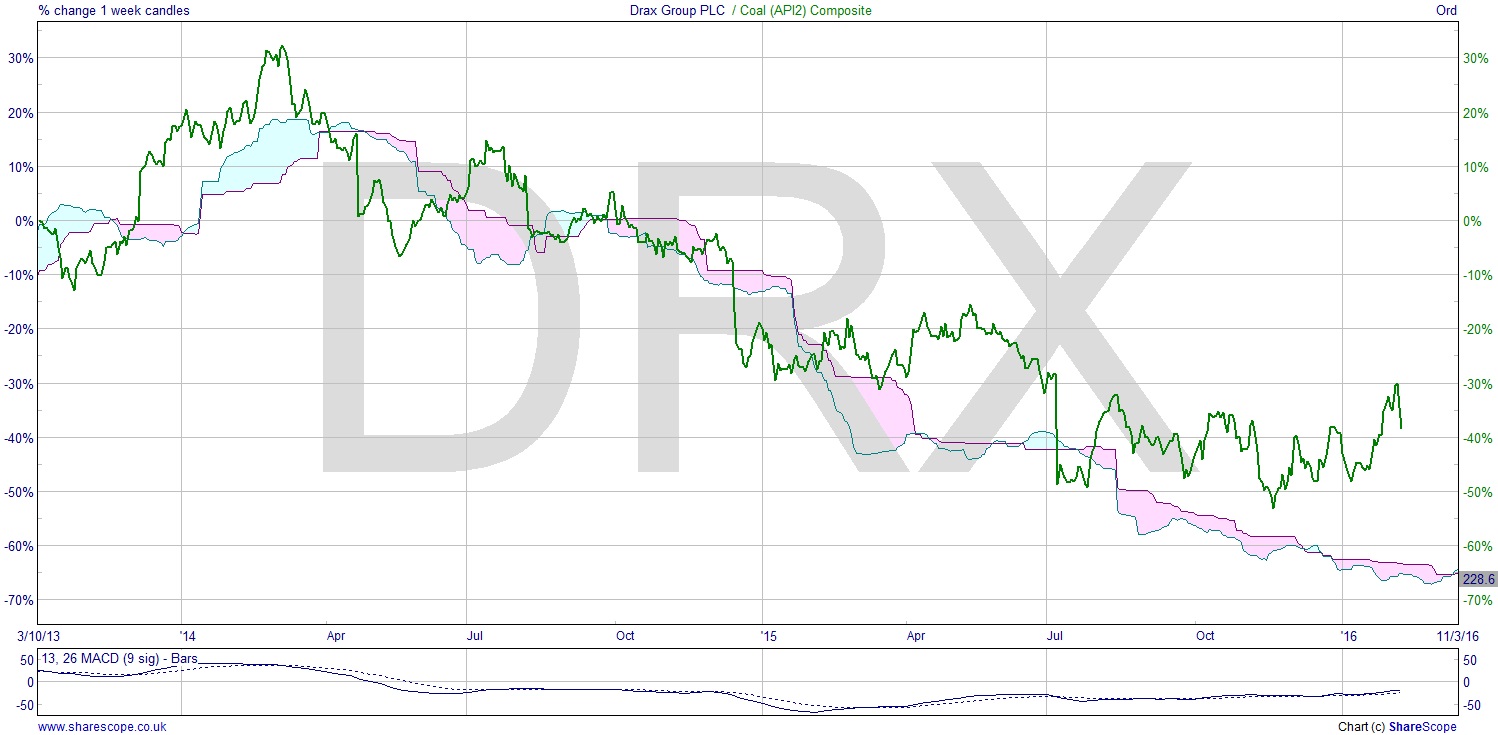

Drax [DRX] looks quite dismal for the shareholders. Possibly trying to break above the cloud and make a higher low, which would be worth a watch. I’ve done a Drax relative to Coal [MTF] chart. With the Ichomoku cloud from the weekly Drax chart still in place it shows that coal and Drax have moved along in tandem most of the time. With the latest fall in coal prices Drax has seen a relative improvement. A spread trade could be in order (i.e. short coal, long Drax) but then you’d have to find somewhere that will allow you to trade coal at a reasonable price and margin.

Another factor of the El Niño is that a lot of weather damage has been done around the Pacific basin. It’s also true here and in Ireland, where lots of flood damage will need repairing, and more likely be insured. This underpins my analysis that Steel, Iron Ore and (as a result) Copper are coming out of their depression to be consumed to repair infrastructure. I’m not saying it’s the start of an economic boom (although it may turn out to be); just that it’s a breathing space for commodities.

Whilst it is possible to trade the commodities themselves, the impact will also be felt by the companies that produce them, like miners. This in turn will make the FTSE 100 look like it’s not failing when in fact the UK broadly is, thanks to the miner-heavy composition of the index.

Antofagasta plc [ANTO] is a copper producer; and whilst there’s a bit of downside to the low of ’09, there’s no reason why it shouldn’t start to improve from here. If we’re looking at lots more flood repairs then we could see a healthy rally here. Why from here? Well there’s a measured move through the congestion area I’ve marked in 2013/14, and that would predict a move to the sort of price we’re at now. MACD supports a rise too. Again one to watch.

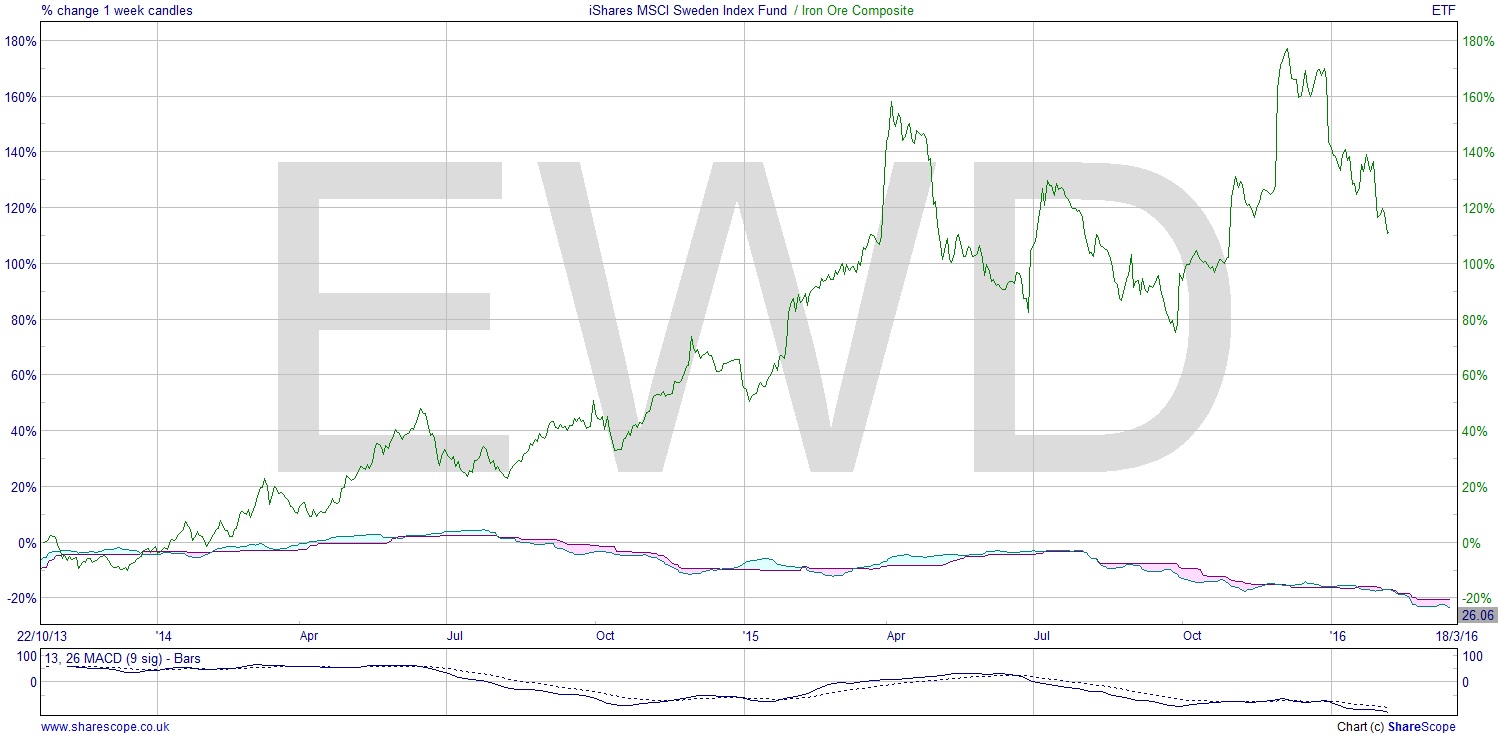

We can also look at countries which are heavy producers of the affected commodities. Sweden is a huge producer of Iron Ore, the largest in Europe. It’s also a steel producer so if both these commodities see an upturn then that has to be good for Sweden.

The simplest way to invest in a country is through an ETF. It doesn’t make for a long trade. So here too we could look at long Iron Ore (yes it is available to spread bet) and short Sweden iShares MSCI Sweden Index Fund [EWD]. With a negative looking chart like this for Sweden itself, I wouldn’t be going long. I can’t even see a reason to. So that would be a spread trade that really takes advantage of the notion that iron ore will turnaround more quickly than the lagging Swedish economy. Sweden is quite dependent on the resources it sells. Timber is another key export, for example. In terms of Iron Ore, it will take longer to hit GDP than the raw material price. The relative price chart shows a H+S since October. Not a huge one but enough to see some worthwhile gains if played correctly. Note: entry can be tricky and counter-intuitive on a spread trade.

Comments (0)