Fund Manager in Focus – Emmanuel Lemelson

As seen in this month’s Master Investor Magazine

“The recent financial abuses in housing caused many to suffer unnecessarily. Critical questions ought to be asked – how did it occur on such a massive scale, and in of all places, the US? Many of the greatest minds in finance have either ignored the issue of economic injustice or perhaps don’t understand it fully, which is a shame because they have influential voices and could affect change.”

– Emmanuel Lemelson

A Singular Man

The hedge fund industry is certainly one of the most exquisite branches of the investment world, where one can find the most disciplined, the most skilled, and the most obstinate individuals who hide behind powerful computer algorithms, rely on rigorous analysis, and seek the most mind-boggling opportunities to squeeze alpha from their investments.

No one could imagine that a man, at the age of 47, seeking a mere analyst job after a few failed ones, and upon his third wife, could lead a hedge fund towards “the best trade ever”. But that was the case with Paolo Pellegrini who led Paulson & Co. toward multi-billion dollar gains after betting against the mortgage collapse in 2006.

At par with some odd success stories like Pellegrini’s, there are some odd ways of making money. We must mention, for example, Carson Block and his Muddy Waters Research. As the name suggests, the company “looks for trouble”, selling the shares of companies with suspicious activities before trying to uncover accounting scandals. Muddy Water’s targets usually experience a downhill ride and in some cases end up being delisted from the exchange.

But there are even stranger relations in the hedge fund world. What do you think is the connection between Faith, Investment, and Photography? Do you believe that studying Theology can help you run an e-commerce business? And what about choosing a Masters in Divinity to run a hedge fund? The puzzle is solved with this month’s focus on Emmanuel Lemelson, the hedge fund manager that is actually… wait for it… a priest!

From Religion…

Emmanuel Lemelson was born in Phoenix, Arizona in 1976. In fact his name was Gregory M. Lemelson but, as he was ordained as a Greek Orthodox priest in 2011, he was granted the ecclesiastical name Emmanuel.

Lemelson studied in Germany for a few years but returned to the U.S. to attend high school in Washington, where he graduated in 1993. At the age of 18, he went to the Jesuits-run Seattle University to pursue a degree in Theology and Religious Studies. After graduating he continued his studies in Theology and obtained a Master of Divinity from the Hellenic College Holy Cross Greek Orthodox School of Theology.

As part of his religious tasks he founded “The Lantern Foundation”, a non-profit foundation focused on supporting religious, charitable and educational causes, where he has also served as President. His theological work is centred on canonical issues in apostolic mission and ethics in relationship to commerce, finance and social justice. On November 2014 he was part of the official Orthodox delegation during the papal visit to Turkey and he fostered a vision that Catholics and Orthodox Christians would soon be reunited after the split in 1054 over disagreement on matters including the primacy of the papacy.

…towards ecommerce

While still known as Gregory, Lemelson began a retail photography business. When the digital world was still in its earliest days, he envisioned its growth towards a mass market. At that time photography accessories were expensive and mostly inaccessible for non-professionals. His goal was to begin a retail business where he could sell budget accessories. At the beginning he started manufacturing accessories at his dorm room but later founded Amvona, a retail website that derives its name from the Greek world “pulpit”. The popularity of Amvona grew very fast and it soon started generating around $40 million in revenue.

Lemelson was always old-fashioned in terms of business management and adopted a frugal approach to life in general. While many neighbour companies were supported by venture capital and managed by “rich kids” from inside “decorator-stylish offices”, his company was founded by owners’ money and his office comprised a simple desk and a large warehouse behind it. Lemelson always favoured cash flows over outside capital as a way of financing a business. “We’ve developed our business the old-fashioned way… we sell products, and we bring in more than we pay out”, he explains. Many companies rely heavily on mortgages, which are often based on optimistic assumptions about future earnings, which most of the time just turn into realised losses. In his view, it is better for the cash flows to materialise first, and only after buy more product and expand the business. This approach inevitably delays growth but can also save the business from being liquidated during tougher times.

Amvona operated as an online retailer between 1999 and 2010 and was once one of the top 10 most visited online photo retailers. It has sold more than 1 million photo accessories to 300,000 customers around the world over its existence. The company pioneered software development, having registered a few patents. At a time when social networking was just a mirage, Amvona was already developing proprietary software to connect its customers through the creation of user profiles, product reviews, exif data and online tracking software. Such technology is now heavily used by online retailers and by Facebook to track user activities.

But it was not only in terms of software that Lemelson pioneered. To offer budget accessories, Lemelson needed to find the lowest cost possible to manufacture the products. At a time many clothing brands were relocating their production facilities to China to cut costs, Lemelson thought about doing the same for photo accessories. But in 2000, no one was doing it with photo accessories. The decision was right and Amvona was able to decimate its competition.

In 2009, Lemelson created a blog providing opinion and analysis on issues of Faith, Investment, Economics and Technology on the Amvona website. One year later, Amvona announced it was discontinuing its e-commerce business. Lemelson’s life was about to acquire a new direction, one that would join Religion with Investment.

While there’s no official explanation for the Amvona e-commerce business discontinuation, it is very likely that at some point competition pressures were too strong for the business to be worth expanding. By 2010, almost all U.S. companies were in some way connected with China and many Chinese producers were already selling directly to the general public at bargain prices. The only way to compete in the photo accessories sector would be through company dimension. Many of the existing retailers were by then large companies taking on massive leverage in the expectation of growing even more, something heavily opposed by Lemelson. ”The time has come when companies are going to have to reinvent themselves because the old paradigm of the same ideas only with more leverage piled on top of more debt isn’t working”. There was no room for Lemelson here anymore and it was time to go in a different direction.

An Eternal Hunt For Value

As a supporter of a conservative business approach, Lemelson was always a critic of the massive leverage taken by companies. In particular, he criticised the behaviour of banks and other financial institutions who contributed to that same excessive leverage and who guided the U.S. economy towards collapse. At certain times there is so much optimism that asset prices reflect conditional events as if they were material realities. Companies like Facebook and others are filled with “users” instead of “customers”, who buy nothing and may eventually disappear, but they’re priced as if those “users” were regular “customers” buying stuff and contributing to these companies’ bottom line. This observation was seen by Lemelson as a big opportunity to enter the fund management business.

In September 2012 Lemelson founded Lemelson Capital Management and created its flagship fund “The Amvona Fund, LP”. The hedge fund is of the long/short bias type with a focus on deep value and special situation investments. As a fund manager, Lemelson has adopted an activist position in several publicly traded companies and often creates some discomfort to the executive management.

In 2014, Lemelson made a short call on World Wrestling Entertainment criticising the deficiencies in executive management. On March 17, 2013 he announced a short position on the shares reporting fair value to be around $8.25 and $11.88. The shares were trading at $30.37 at the end of that day. Less than two months later and after a worse-than-expected profit statement and a failed deal with NBC, the shares were down 63%, trading at $11.27 on May 5. Lemelson covered the short (and even reversed it to a long position, but ended closing it recently due to the same management problems he pointed out in the past, and which he believed to be unsolved).

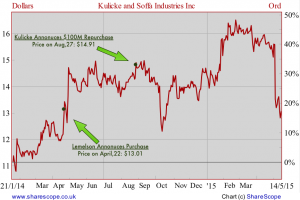

Last year, on 22nd April, Lemelson announced the Amvona fund had been acquiring shares on Kulicke & Soffa Industries while, at the same time, wrote an open letter to the management of the company suggesting a repurchase of the shares, as the company was sitting on a large cash pile with no debt and was not paying any dividends to shareholders. Four months later, on 27th August the company announced a $100 million share repurchase programme. The shares were up 15% by then.

The Amvona fund has been cited several times as a top performing hedge fund by Barron’s and BarclayHedge. Recently, the WSJ published a list with the top 10 hedge fund performers that primarily take long/short positions in US equities. The Amvona fund tops the list with a reported 1-year performance of 58.71% for the interval between January 7, 2014 and January 7, 2015.

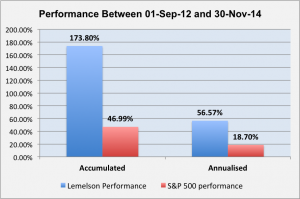

While the Amvona Fund does not have a large track record for us to evaluate it properly, its performance so far has been stellar. The fund reports an accumulated net performance of 173.8% since its inception on 1st September 2012 until 30th November 2014, which corresponds to a 56.5% annualised gain, largely surpassing the S&P 500.

Final Words

In a world where replicating what others do while taking on some extra leverage seems to be the main game, there are still a few that detach from society in general to seek out value. Lemelson proves that it doesn’t matter what you do but how you do it. Be it e-commerce, finance, investment, or theology, a successful individual is one that is able to at some point detach from the herd and start thinking independently.

Comments (0)