Is It Time for Value Funds to Outperform?

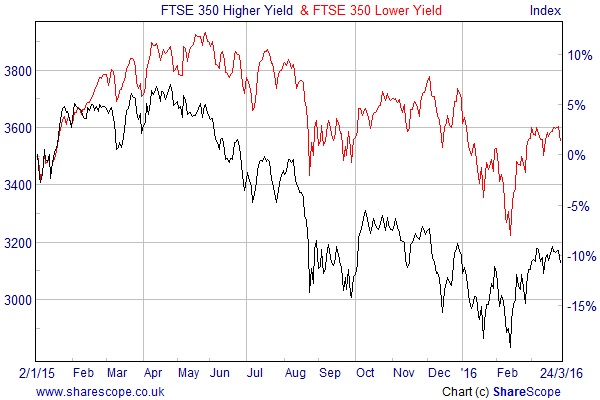

Views differ as to whether it is better to be a value or a growth investor, but over the last few months there has only been one winner. Since the start of 2015 the FTSE 350 Lower Yield (growth) index has risen by about 1%, whereas its value based counterpart, the FTSE 350 Higher Yield index, is down by 10%.

Growth stocks are those that are expected to generate above-average earnings growth and this will normally be reflected in a higher price/earnings ratio. They make a good investment if you believe that the growth rate will exceed the rate that’s already priced in.

A value stock is one that has fallen out of favour with investors and has a correspondingly low PE ratio and high dividend yield. These can be highly profitable if the company is able to turn things around.

The FTSE 350 higher and lower yield indices are not a perfect measure of value and growth, but they provide a decent proxy to assess the relative attractiveness of the two methodologies. Whenever one opens up a lead over the other it tends to be quickly closed down again, which suggests that value stocks have been oversold.

There is a growing view in the market that value will recover and come back into fashion. If this is the case it could be a good time to invest in a fund with a staunch, value-based approach.

A good example is the Aberforth Smaller Companies Trust (ASL). This £951m investment trust was launched in 1990 and invests in a diversified portfolio of small UK quoted companies. It has a good long-term record with the shares up 75% in the last five years, but is currently trading on an almost 13% discount to NAV.

Aberforth Partners, the firm behind the management of the trust, use fundamental analysis to identify shares that they believe offer relatively attractive value within the prevailing stock market environment. They also keep in regular contact with the managers of the companies.

The European Investment Trust (EUT) provides a value-orientated exposure to Continental Europe. It is run by Edinburgh Partners and is up 29% in the last five years. The shares are currently yielding 2.4% and trading on a wider-than-normal 10% discount to NAV.

Edinburgh Partners uses disciplined and intensive research to identify stocks that they consider are clearly undervalued. They believe that the undervaluation arises because the stock market’s investment horizon is too short. The firm looks for opportunities by forecasting each potential holding’s profits, cash flow and balance sheet over the next five years to come up with their own intrinsic value and will then buy it if this is well above the current market price.

Edinburgh Partners is also responsible for the EP Global Opportunities Trust (EPG), which invests in a global portfolio of undervalued shares. The £111m fund is up 38% over five years and is trading on a tighter discount than the others at just 5.6%.

Another option is Fidelity Special Values (FSV), a £497m UK closed-ended fund that is run by Alex Wright. The manager uses a value or contrarian approach to stock selection and looks for companies that have underperformed, but whose share prices offer a degree of downside protection. He also invests in businesses where he thinks the future growth potential is being overlooked by the market. The fund is up 41% over three years and is trading on a 6.3% discount to NAV.

It is not dissimilar to the investment strategy followed by Alastair Mundy in respect of the Temple Bar Investment Trust (TMPL). He is a fellow contrarian investor and looks for FTSE 350 companies that he thinks are undervalued. Normally these will have experienced share price falls of at least 50% from their highs, but whose balance sheets are in reasonable shape. The £665m fund is up 33% over five years and the shares are currently trading on a discount of 9%.

If history is to repeat itself it is likely that value stocks will pick up relative to growth. If they do then these closed-ended funds would be well placed to benefit, especially in view of the wider than normal discounts to NAV.

Comments (0)