Decent Entry Point for P2P Global Investments?

Investors who are looking for an attractive source of income may want to think about using a portfolio of peer-to-peer loans. The obvious way to do this would be to open an account at a lending platform such as Zopa, Ratesetter or Funding Circle, but the easier – and currently better value – option would be to buy an investment trust that specialises in this area.

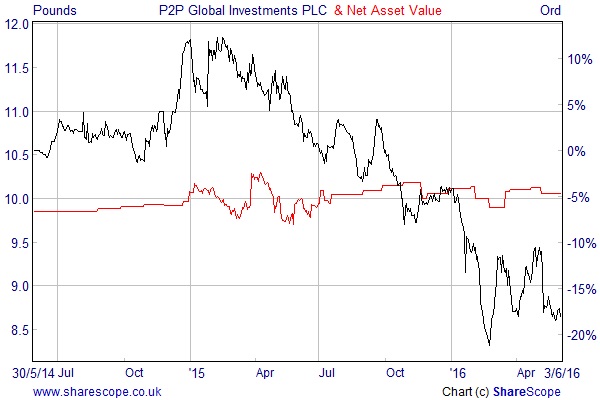

The first fund to target peer-to-peer loans was P2P Global Investments (P2P) and the recent weakness in the share price may have created a decent long-term buying opportunity. Over the last 12 months the shares have fallen from £10.95 to £8.72 and they are now trading on an estimated discount of 12.8% to the latest net asset value (NAV). The fund has a market value of £755m and is yielding an attractive 6.8%.

P2P generally invests in peer-to-peer loans with targeted annualised returns of 5-15% across a range of different platforms, geographies and credit risk bands to achieve a diversified portfolio. It also holds equity stakes in some of the lending platforms. The aim is to generate an attractive level of dividend income and capital growth for shareholders.

At the end of April the largest allocation was the 60.5% exposure to US consumer debt, with a further 19.5% loaned to European consumers. The other 20% was split between loans to small businesses, cash awaiting investment, equity stakes in some of the platforms and sundry smaller areas.

It is a really diversified portfolio with 138,532 loans worth an average of £8,139 each with a weighted average life of 1.75 years. The weighted average coupon is 10.5% and the fund has a target default rate (level of bad debts) of 2% to 4%.

From the point that it was created in June 2014 to the end of April 2016 the fund made a total NAV return of 10.9% − before adjusting for the dividends − with gains in every month, but the share price performance has been a lot more mixed. The shares started well, but then fell 14.66% in 2015 and followed this up with an 8.39% loss in the first four months of this year.

According to the recent annual report, total dividends of 59.2 pence per ordinary share paid in 2015 were equivalent to a return of 6.12% when measured against the average NAV over the 12 months. It is also worth noting that the company has borrowed additional funds to diversify its financing, and at the end of April had a debt to equity ratio of 59%.

There are two main reasons for the weakness in the share price, with the first being the deterioration in the state of the global economy. This could potentially result in a higher level of bad debts, although it is early days for the industry and hard to know what to expect.

The other key issue is that sentiment has been negatively affected by problems at the US peer-to-peer provider, Lending Club. P2P has said that it has no equity exposure to the company and had only invested in its ‘prime’ loans, whereas the difficulties are all linked to its ‘near prime’ program. Nevertheless, it is obviously a concern.

There are also a number of other peer-to-peer investment trusts including: VPC Speciality Lending (VSL), GLI Alternative Finance (GLAF), Funding Circle SME Income (FCIF), the Honeycomb Investment Trust (HONY) and Ranger Direct Lending (RDL). They all offer different types of exposure and varying levels of risk.

The advantage of investing in one of the funds rather than making the loans yourself is that you can achieve a much greater level of diversification and benefit from the due diligence of the managers in choosing the right borrowers. You can also sell it whenever you want. If you invest via a Stocks & Shares ISA all the interest would be tax-free in the same way that it would if you made the loans using one of the new Innovative Finance ISAs.

The main downside of the funds is that the shares are affected by market sentiment and can slide to a large discount to NAV, which isn’t the case if you provide the loans yourself via one of the platforms. You also need to be willing to accept the high level of gearing.

Investors who are comfortable with this will struggle to find a higher source of income from more conventional asset classes and could use the 12.8% discount to NAV as a decent entry point for P2P Global Investments.

Comments (0)