Spring Round-Up: AAU, CNR, HRN, HUM, KEFI and PAF

As I hope readers realise, I’m not in the business of managing their investments. The ideas I put up are only for there and then. I don’t wield my pen often enough to track them and recommend taking profits (as, luckily, has been mostly the case so far – although cynics will say I’ve been helped by strong gold).

But now and again I will take stock. Compared with levels when I initially commented, 13 of the 14 shares have gone in the direction I thought they would (eleven up, two down or stagnant) but one (Ariana Resources) has jumped by 58% whereas I was iffy about it. So let’s start there.

My reservation about Ariana Resources (AAU) was that a close look at its production profile and costs over the first few years at the Kiziltepe mine showed that reported profits were likely to be erratic (due to mining highly variable proportions of silver versus gold). More importantly (in view of its dreadful record of shareholder abuse through never ending dilutive cash raises), of the cash to be generated (perhaps starting by mid 2017) and which observers who were valuing Ariana on a NPV basis relied on for their forecasts of ‘value’ and dividends, most would have to go to drilling and developing the ‘satellite’ resources that it has been spending to discover. It will depend on these in order to increase mine life beyond the short eight years currently in the plan.

(In my October 15th review I said, “In about two years from now if gold stays flat, Kiziltepe should start generating about $6-7m pa for Ariana, but only for two-three years. So the shares might start to anticipate the fact.”)

With its proximity to production, the strong gold price has now helped push up Ariana’s shares, as has news of those drilling results. In addition to that has been the good news that ‘Death Spiral’ financier Lanstead Capital has reduced its 7% shareholding to below 5% at share prices (presumably) that will have avoided the requirement for Ariana to report a loss from the associated 2013 and 2014 equity ‘swap’ arrangements (for which the ‘benchmarks’ were share prices of 1.22p and 1.33p)

But also (and I think pushing Ariana’s shares at 1.4p almost into the ‘spike’ category) has been a very bullish evaluation by the company’s broker in a February report. In it, he has ‘inched up’ various assumptions to justify a ‘target’ share price double the present level (and in my view double their current real value).

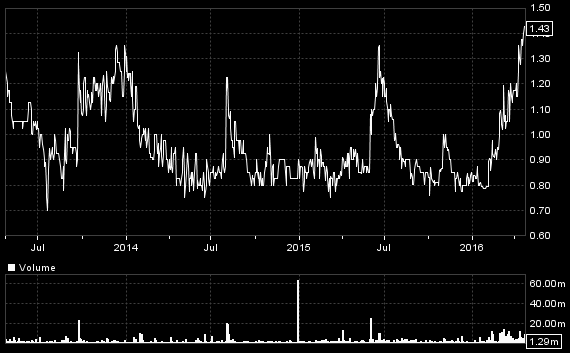

Ariana Resources – 3 yrs to April 2016

According to the latest 2013 DFS, Ariana’s 50% share of the Kiziltepe project’s NPV10 at $1,250 gold for the current eight year mine plan is about £12m (i.e. only 10% above the present market cap – at an 8% discount rate it would be about £15m, or only 30% above the current share price).

But the broker report adds that the resources it expects will be confirmed at the various potential satellite pits that drilling has identified, extending its assumed mine life by about 50% so that it can ‘inch up’ the resulting NPV to £19m, which it then (you’ve guessed it) divides by the current shares in issue to arrive at 2.35p of its total ‘target’ of 2.79p for the shares.

Needless to say, this is grotesquely wrong if only because there will be substantial costs to keep drilling those satellites and to confirm their economics, and then to bring them into production. To do so in the long ten years’ time from now, even though Kiziltepe should by then have generated some cash from Kiziltepe, Ariana will no doubt continue to dilute shareholders’ interests, and therefore any ‘per share’ value for whatever additional NPV the satellite pits will generate.

That is not the only ‘inching’ up by which that broker arrives at its ‘target’. As has been long known, Ariana has other assets including its 49% joint venture with Eldorado Gold at the 1Moz Salinbas gold prospect in SE Turkey. And it has recently entered into an Australian lithium joint venture to which the broker attributes 0.08p per Ariana share. For Salinbas, based on a ‘discovery cost’ of $7/oz, the broker adds 0.36 per Ariana share, which is probably conservative in light of Ariana’s report of other parties’ interest following Mariana Resources’ high quality 3Moz Hot Maden gold discovery nearby. But only a sale would crystallise value for Ariana, and if it does I bow to fate.

So Ariana’s shares have benefited from a stream of ‘good’ news in addition to a strong gold price, as well as the timing of what I think is a grossly ‘tweaked’ broker review. If gold holds, as one of the few goldies approaching production fairly soon Ariana’s shares should stay healthy for the moment. But at some point those reservations will come to be recognised.

In my October 15th review I felt that the attractions investors might feel for the fairly good economics for Kiziltepe in the near term (even if less valuable than the broker report implies) did not take account of the further heavy spending Ariana will almost definitely have to incur in the medium term.

So Ariana’s record of heavily diluting shareholders’ interests here and now, in order to fund exploration ventures that will only benefit the distant future, should be heeded. Moreover, don’t be fooled when studying Ariana’s long-term share price chart. While the present share price looks no higher than in the past and ‘must’ therefore imply better value now that production is closer, in reality the chart is an illusion which obscures the fact that since 2012 shares in issue have more than doubled – even compared with the ‘projection’ of 400 million shares once Kiziltepe was fully funded.

As for my other coverage, shares in Condor Gold (CNR) (52p) have only just started to move (perhaps anticipating its appearance at the Master Investor Show) despite news that gold gurus Sprott Gold Resources Fund and experienced Canadian mining entrepreneur Ross Beaty have subscribed $2.6m at 40p per share (with 2 yr warrants at 60p) to give Ross a 7.2% shareholding. Ross has been promised that his holding won’t be diluted in the future, and how this will be achieved remains to be seen.

Shares in Hornby (HRN) have hardly recognised the March 30th announcement that talks continue with its banker Barclays, who has agreed to waive the covenant tests that Hornby was in line to breach, and that trading has been in line with expectations. These were of second-half sales down 2% year on year, mainly due to the teething problems in its new European sales distribution systems offsetting ‘encouraging’ 4% like-for-like growth in the UK (79% of 2015 sales). This is reassuring news, although investors no doubt fear another fundraise to redress the possible resulting hole in the balance sheet and to reassure Barclays. Even so, as I pointed out in my February 19th piece, the market cap is now around only half annual sales and there is no suggestion that Hornby’s business in general is at any risk. Its valuable trade marks and the appetite of competitor US Bachman Industries to increase its market share put a solid floor under Hornby’s shares. The next news will be with the annual results in June.

Hummingbird Resources (HUM) has also been strong, mainly because rising gold emphasises the economic attractions of its Yanfolila project, and also on the announcement of a six month extension to its $15m bridging loan from Australian Taurus Mining Finance while details of the full funding package promised are worked through. To remind readers, I felt Hummingbird to be one of the more attractive investments around on the basis that Yanfolila will be financed by a 100% loan, and therefore with no dilution of shareholders’ equity. Bearing in mind my reservations about share valuations based on NPVs – but which if all goes well won’t apply here (quite the contrary as I explained last time) – the latest mining plan at Yanfolila shows a £112m NPV at a $1,250/oz gold price and a realistic 8% discount rate, against Hummingbird’s current £25m market capitalisation.

The cover for a loan provided by a 60% IRR for the project explains why Taurus (and any other banker) will be happy to provide it, while the reported “all in sustaining cost” (although not the whole picture) of only $695/oz will attract investors who believe last Decembers’ low $1,060/oz gold price has been left well behind. Meanwhile, there is Hummingbird’s much larger 4.2Moz Dugbe gold project in Liberia to follow on, and while that will encourage long-term investors, it does mean that Hummingbird might be encouraged by share strength to tap investors soon for funds for that.

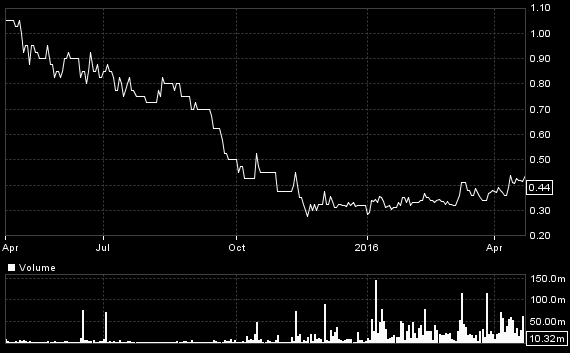

Kefi Minerals (KEFI) has also been the subject of a bullish broker report which once again concentrates on the ‘NPV per share’. Given the fact that the final bit of the valuation jigsaw – i.e. the likely high cost of the large streaming element of the Tulu Kapi financing – is not yet in place, this ‘NPV per share’ can be demolished as the wrong approach. I thought the shares were primed to go in my February 5th review, but since then a hefty placing has increased shares in issue by 19% and reduced any per share ‘value’ by 10%. Kefi may well be the next Ariana spike, but until that final valuation jigsaw is announced, sensible investors won’t hop onto the ‘approaching production’ bandwagon yet, even though some seem to be doing so already.

Kefi Minerals – Year to April 2016

Pan African Resources (PAF) is ahead by 61% since my strong endorsement in mid January, so the juicy (and unusual for a miner) prospective 9% dividend yield available then to anyone who acted promptly is no more. Partly, the share performance is down to better than expected results for the half-year to December, showing a near-80% improvement over the previous six months despite an exceptionally low $1,110 gold price in the period. The improvement came about mainly due to higher productivity at a cost that was substantially lower, courtesy a severe fall in the Rand versus the Dollar.

From now on, Edison’s valuation, assuming gold remains flat, based on its calculation of the NPV of its forecast of future dividends (i.e. lower than would be a valuation of the total cash inflow to the company rather than to shareholders) is 19.6p. Given that is at a conservative 10% discount rate, and assumes no increase in the gold price, and that Edison thinks a comparison with other S. African and world goldies such as streamers still shows PAF to be markedly cheaper, that underpins my thinking that investors wanting a dividend (still yielding a not to be sneezed at 6%) should hold on. Others, though, might want to redeploy their quick profit into the likes of the higher reward (against a not too high additional risk) prospects like Kefi Minerals.

Post-Script

More weasel words (from a recent ‘paid for’ research report) – see if you can spot them!

Cradle has today announced the results of the DFS on the Panda Hill Niobium Project. Cradle’s 50% share of NPV10 equates to US$1.50/share, i.e. Cradle’s shares are currently trading at just 13.5% of the value of its share in the project. Assuming that its share of initial capex (US$102.2m including working capital) is 50:50 debt:equity funded, it will therefore need to raise just US$51.1m (A$65.7m) in equity finance to advance it.

Comments (0)