Oil May Derail Russian Stocks (Again)

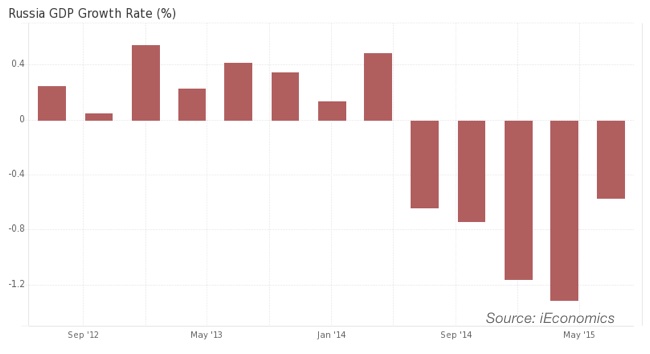

Back in 2014, and mostly due to the slump in oil prices, Russia fell into a downward spiral that saw the value of its currency slashed and its economy enter a recession. Almost two years later, the currency and the stock market market have recovered, but the economy is still underwater, with GDP declining for five straight quarters. While the economy recorded a better performance than many were anticipating, it may yet see its full recovery postponed by further oil price weakness. With VanEck Vectors Russia ETF up 21.6% year-to-date, it may be time to take profits, as pressure on oil prices is mounting and will weigh negatively on Russian equities.

Russian equities have in fact done very well so far this year, in particular when compared with the MSCI World index, which is registering a tiny 2.3% gain. While the developed world is split between small gains and small losses, some emerging markets, like Russia and Brazil, managed to recover at a very fast pace. With commodity prices recovering, in particular since mid-January, investors anticipated the economic gains and pushed equities higher in those countries. But, at a time when commodities are losing some of their previous momentum, investors may revert to real indicators and re-evaluate their holdings. While commodity prices are now higher than at the beginning of the year, economic data in Russia is still ugly, with five straight quarter of negative GDP growth. The question to ask at this point is: Is the 21% profit from the broad equity market reflecting economic prospects? I believe it is not.

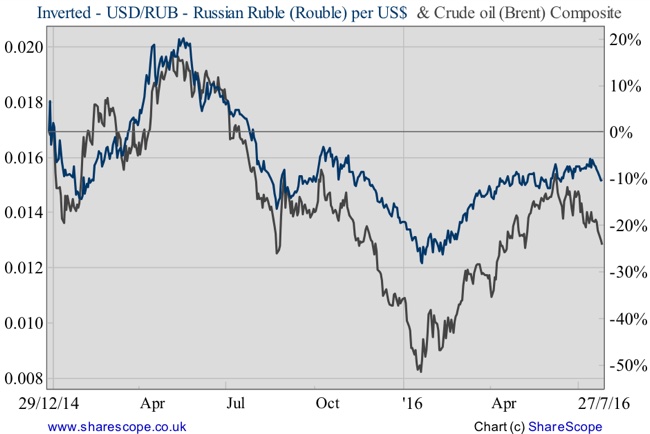

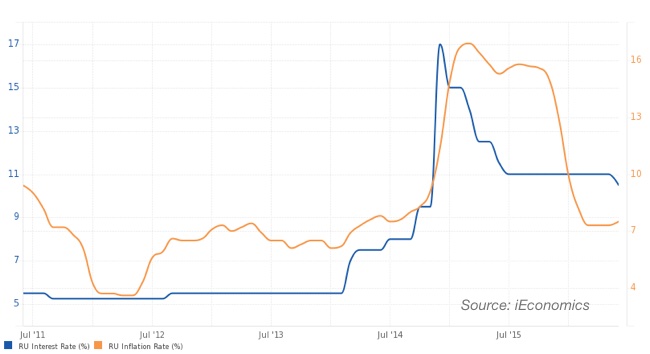

During 2014 oil prices declined quite rapidly, from $110 to $50, as Saudi Arabia opted to favour market share over prices. As the third largest oil exporter, Russia was one of the biggest losers and its economy dived into turbulent waters that led to massive outflows of capital and to the inevitable depreciation of the rouble. The rouble, which was trading at 32 to the dollar when oil prices were at $110, tumbled to 82 against the dollar. To avoid a total collapse of the currency and prevent the country from experiencing hyperinflation, the Central Bank of Russia (CBT) increased its key rate from 5.5% at the beginning of 2014 to as high as 17% at the end of that same year. Although preventing an even worse scenario for the Russian economy, such efforts weren’t enough to prevent the downfall of the rouble, as the currency has tightly mirrored oil prices over the past few years.

The above chart demonstrates how tightly the rouble has been moving with oil prices, even though oil prices seem to decline faster than the rouble during downtrends. The reason for this may be the delayed effect oil price fluctuations have on the economy. Fortunately for Russia, oil prices bottomed near $30 in January and since then have experienced an extraordinary recovery from $30 to near $53 (as measured by the Brent composite). Such a recovery helped the Russian economy stabilise and pushed the rouble higher to trade as high as 62.75 to the dollar.

Since June, reports have been showing that gasoline is stockpiling at oil refineries. With oil prices trading at very low prices for so long, these refineries took the opportunity to accumulate their main raw material at cheap prices to then make a bigger profit on the sold gasoline products. But although gasoline demand is increasing, supply has increased much faster, leading to the accumulation of stocks at refineries. Gasoline prices have declined by 20% since peaking two months ago and, as a consequence, oil prices have also declined by 16.7% since peaking near $53 on June 8. The outlook for oil and its derivatives isn’t good for the next few months and oil prices will likely ease slightly. If this predicted outcome turns into reality, it will weigh negatively on Russia, undermining hopes for a late-2016 recovery and postponing it to 2017 or beyond. In my view, the Russian economy has adjusted well to a new reality. Nevertheless, the equity market is probably anticipating too much, which suggests it could be wise to reduce exposure at this point.

While I believe the outlook for Russia is deteriorating a little, I still think that many things have improved. Inflation, which galloped to 17% at the beginning of 2015 and necessitated hawkish action from the CBT, has now eased to 7.5%. This has allowed the CBT to slash its key rate from 17% to 10.5%, which is more than welcome in a time of recession. Inflation and capital flows seem much more stable today than they were 1-2 years ago, and many investors even use the rouble as a carry trade, benefiting from its high yield. I am not of the opinion that the rouble is stable enough for such a trade, but credit should be given to the fact that the quick adjustment in the rouble allowed by the CBT and the government in the past has helped stabilise the economy and the currency.

Unless there is a sudden massive rise in oil prices, which seems unlikely, the Russian economy will probably continue to struggle. Under these circumstances, the CBT may wish to continue slashing its key rate. While the central bank is not expected to do anything next Friday, I believe it will slash its key rate by more than expected until the end of the year. With inflation contained in single digits, the depreciation of the rouble is more than welcome at the Kremlin, as it would increase oil revenues. At the same time, the last two years have led to some adjustments aimed at replacing some imports with a new “Made in Russia” mentality, which reduces the impact of depreciation on measured consumer prices. Trading at 66.30 to the dollar, I believe there is still room for further declines in the rouble, as the respective central banks and economies are on completely opposite trajectories.

Comments (0)