Yield and recovery prospects at Pan African

Current mid price: 9.0p

Market Cap: £168m

Possible yield: 9.0%

If, in the present environment, we were to point to a producing gold miner paying a secure looking more 6%+ historic yield, with every prospect of useful medium-term capital appreciation and a higher yield, you might say “pull the other one”. But with UK-listed South African mid-tier gold miner Pan African Resources (PAF) it would look to be true. With its main listing in Jo’burg and a secondary one on AIM, PAF has one of the strongest balance sheets among its peers and one of the world’s highest grade, long life, low-cost mines. As a result it does not appear, in contrast to many mining majors, to be in danger of reducing its dividend – unless, that is, the gold price (and the Rand) falls completely out of bed from here ($1,090/oz). Instead, the 0.54p paid in December for the latest full financial year to June 2015 looks like being increased this year, and if it returns to the previous year’s 0.82p would give investors a generous yield which could increase steadily thereafter. (Note that the dividend I quote is before a net 10% S. African withholding tax to UK investors.)

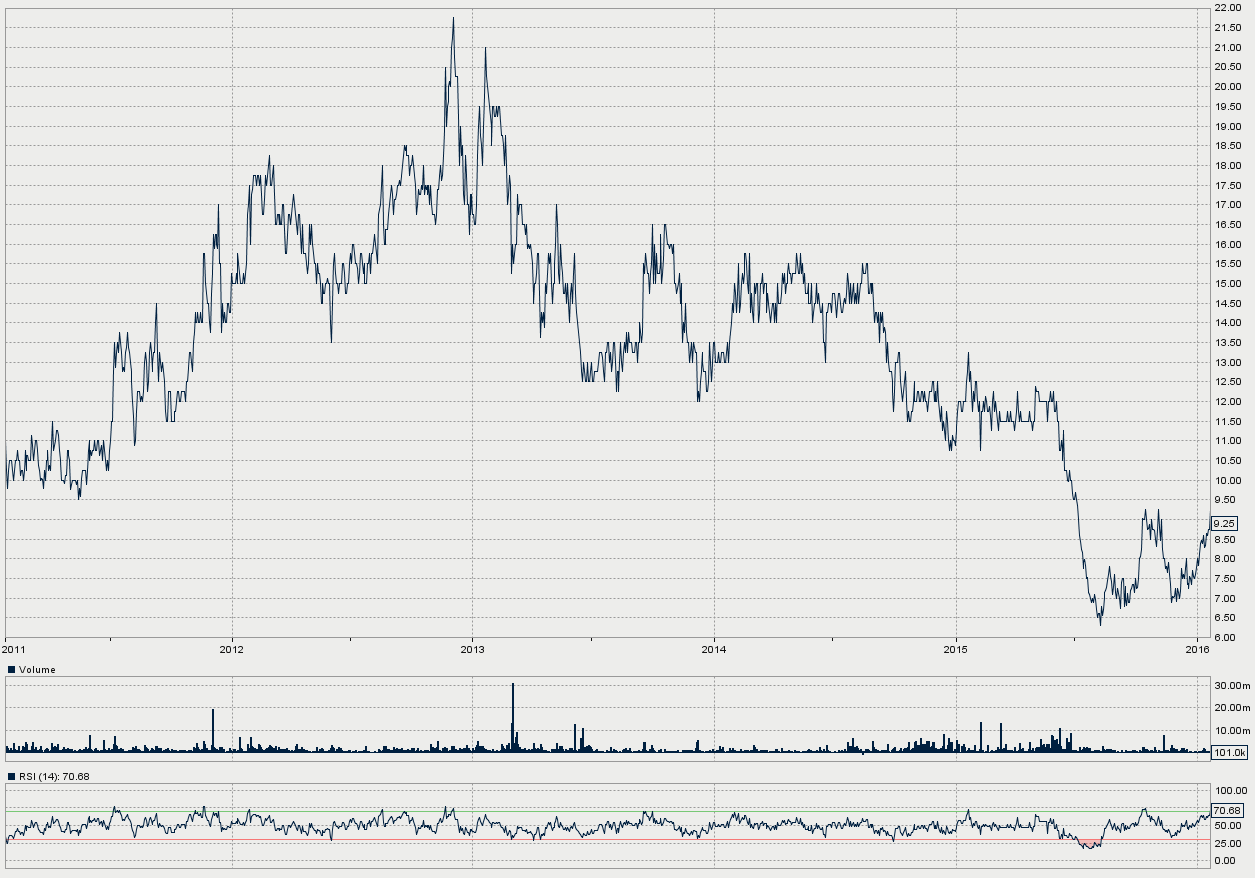

Naturally, along with its peers, PAF has not been immune to the troubles not only of the gold price but of high cost inflation in South Africa. Along with (now resolved) production problems in 2014/15 at what was expected to be a large earnings-enhancing acquisition, and investors’ aversion from South Africa’s depreciating currency, its shares since 2013 have reversed a previous up-trend that was based on investors’ perceptions of an excellent growth strategy and management.

But as the chart shows, having fallen to 1/3rd their late 2012 peak, the shares now look to have commenced a recovery (which started before the gold price bounced back) in anticipation of earnings per share in the current year (to June 2016) returning at least some 60% towards their 2014 level. Even at the present low gold price, first half earnings per share were 65% ahead, with analysts forecasting a further rise in the year to mid 2017. At the current gold and share price, the current year PER would be around nine times. If by 2017 gold recovers to $1,400, the PE would be less than 4 times. (Judging the shares’ value on a PER basis is more appropriate than the DCF/PV values that are used for development stage miners because PAF is already producing steadily; has little need to raise new funds unless for acquisitions; has no need to repay mine development loans; and still has (at least) a 17-20 year life ahead of it.

Up to its setback in 2014/15 PAF had returned impressive growth without having to resort to shareholders for too much cash for expansion. Starting out on AIM at 3.5p in 2004 with a market cap of only £12.3m, by 2013 that had risen to £260m (at 18p) of which only £59m had been contributed via share issues with no resort to any borrowings, and with growth coming from good management of various acquisitions. Of these the most significant, in 2007, had been that of Barberton Mines, which operates one of the highest grade long life underground gold mines in South Africa. Barberton was acquired cheaply, along with the smaller Phoenix Platinum, from distressed previous owner South African metals conglomerate Metorex, who had run into financial problems at some of its other operations following the 2007 crash.

Those acquisitions along with minimum share dilution helped spur a 63% increase in PAF’s EPS in 2009, and between 2008 and 2014 a 3.4 fold increase in revenues and a 4.6 fold increase in operating profit in sterling terms.

The next acquisition, in March 2013, was of the equally well established Evander Goldmines, which brought in annual gold production (initially) of about 95,000 oz, slightly smaller than that of Barberton. Evander was acquired from giant Harmony Gold, who wished to exit South Africa to develop its prospects in the Far East, and it promised an even better return. Together with their respective expansion opportunities PAF’s stated ambition is (still) to increase gold production from its various operations from 176,000 oz in 2015 to 250,000 oz before too long, while at the same time reducing costs.

It was these expansionary projects (including a new and profitable tailings recovery operation) that between 2013 and 2015 allowed PAF’s revenues to hold up well in sterling terms during a time when the Rand was falling, even though local cost inflation and a lower gold price put pressure on margins, and profit in sterling fell from £34m in 2014 to £16m in 2015. Part of this was the (anticipated) effect of a mining programme at Evander involving the mining of a lower grade ore before returning to the normal higher grade. That project has only just finished, so that the Evander mines are expected to produce progressively more and higher grade gold from now on.

At Barberton, there were also operational problems in 2015, principally flooding (after unusually high rainfall) and the contamination of the biox gold recovery plant, so that recovery here will add to the expansion and recovery elsewhere.

Obviously, from now on the gold price, and to a lesser extent the Rand exchange rate, will determine stated results in sterling and the share price. But with the increased gold production in view, it would need a fairly drastic hitch to prevent some earnings improvement, while the company’s promise of a ‘progressive’ dividend policy from now on, together with any further recovery in gold, ought to support the shares.

In addition, although a PER and dividend yield basis is preferred for an existing long-life miner, one analyst who goes by the discounted (10%) value of the forward stream of his expected dividends places a value on the shares at the current ($1,070/oz) gold price of 12.5p – which if gold recovers to $1,454/oz would increase to 25p. Those expected dividends are of course not the only return shareholders can expect, because cash retained can be expected to be invested to expand PAF’s assets.

The danger is that if the Rand falls much further (it is very weak lately due to political problems in South Africa) the value of the dividend in sterling will be reduced. That, however, might be compensated for by a probable increase allowed for by the fact that PAF’s earnings are dominated by the US dollar gold price, which in the last few years has translated to a near static local gold price in Rand.

So investors looking for yield and some capital appreciation, and who are hopeful of a continuing recovery in gold (currently strengthening on the turmoil long predicted by those who think the global economy is in trouble) might do worse than look to this share. Although dividends so far have been paid only in December, the company has said it will consider an interim dividend this year.

Comments (0)